Apari

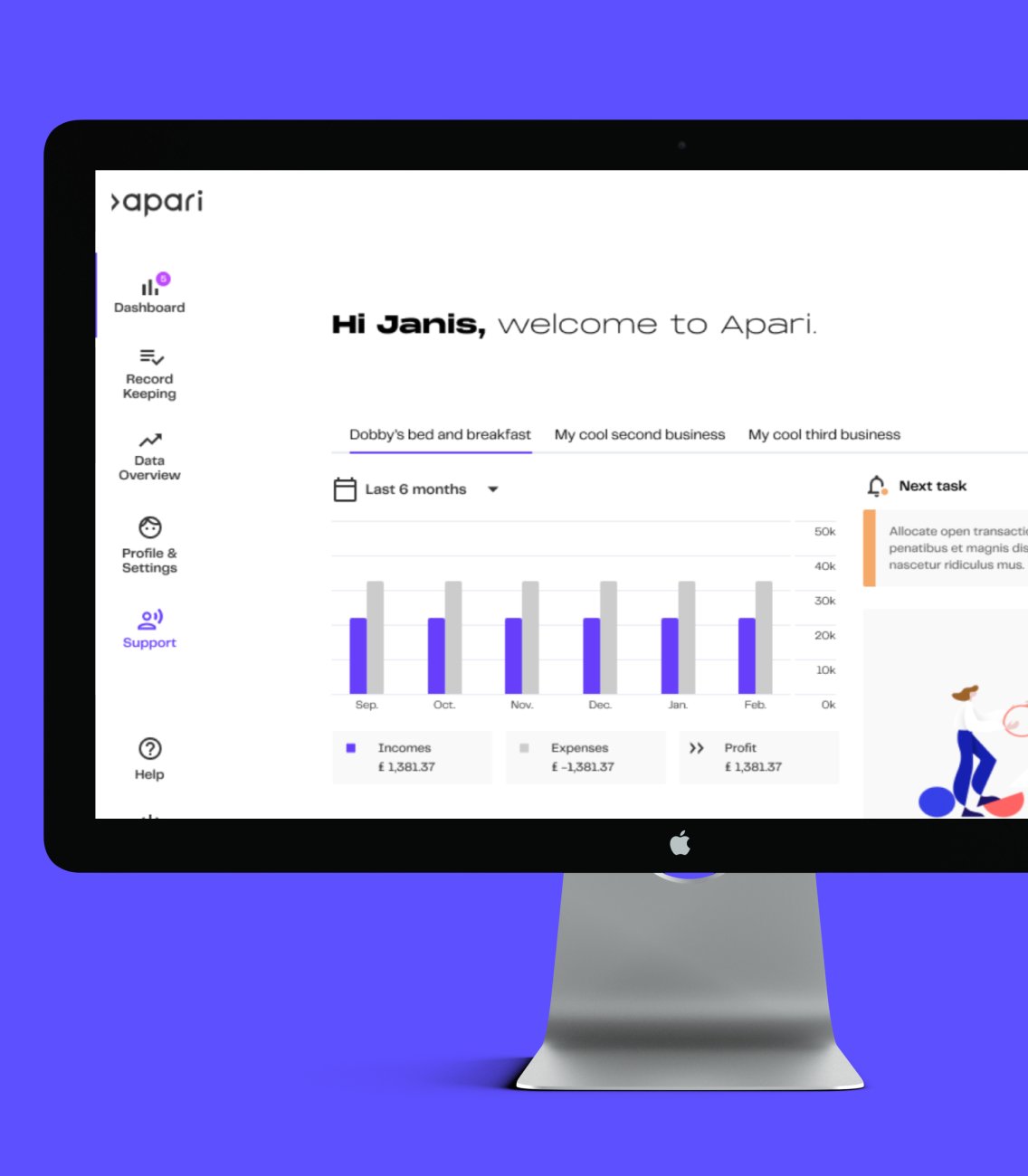

MTD COMPLIANT SELF ASSESSMENT SOFTWARE

Client

Apari

Industry

Financial technology

Team size

10-15

Time frame

Ongoing

Technology used

Apari

Financial technology

10-15

Ongoing

HOW WE MADE IT WORK

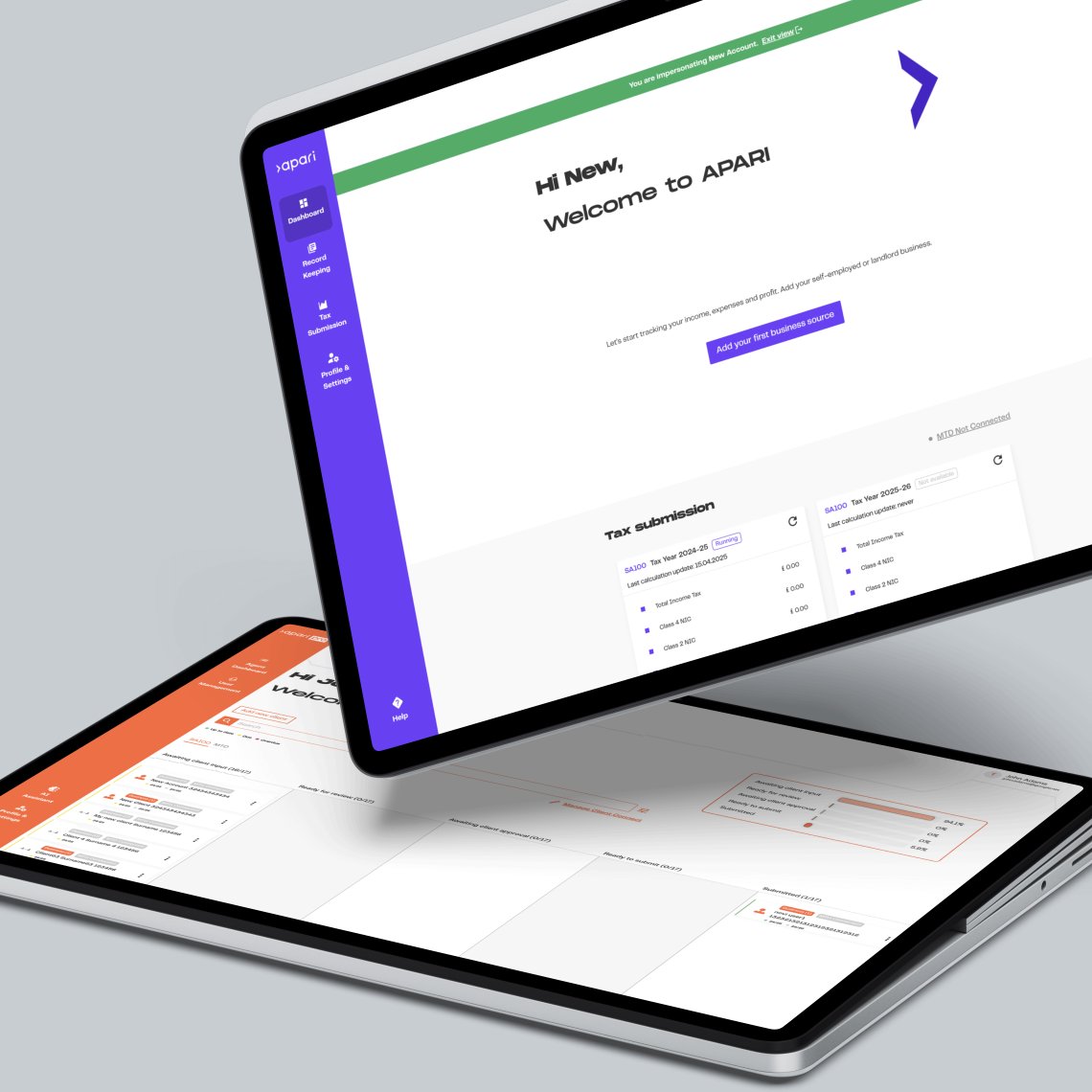

Our Self Assessment solution simplifies transaction tracing, allocation and categorisation, as well as tax submission.

Apari works for both individuals and tax professionals by making tax filing easier, faster, and safer.

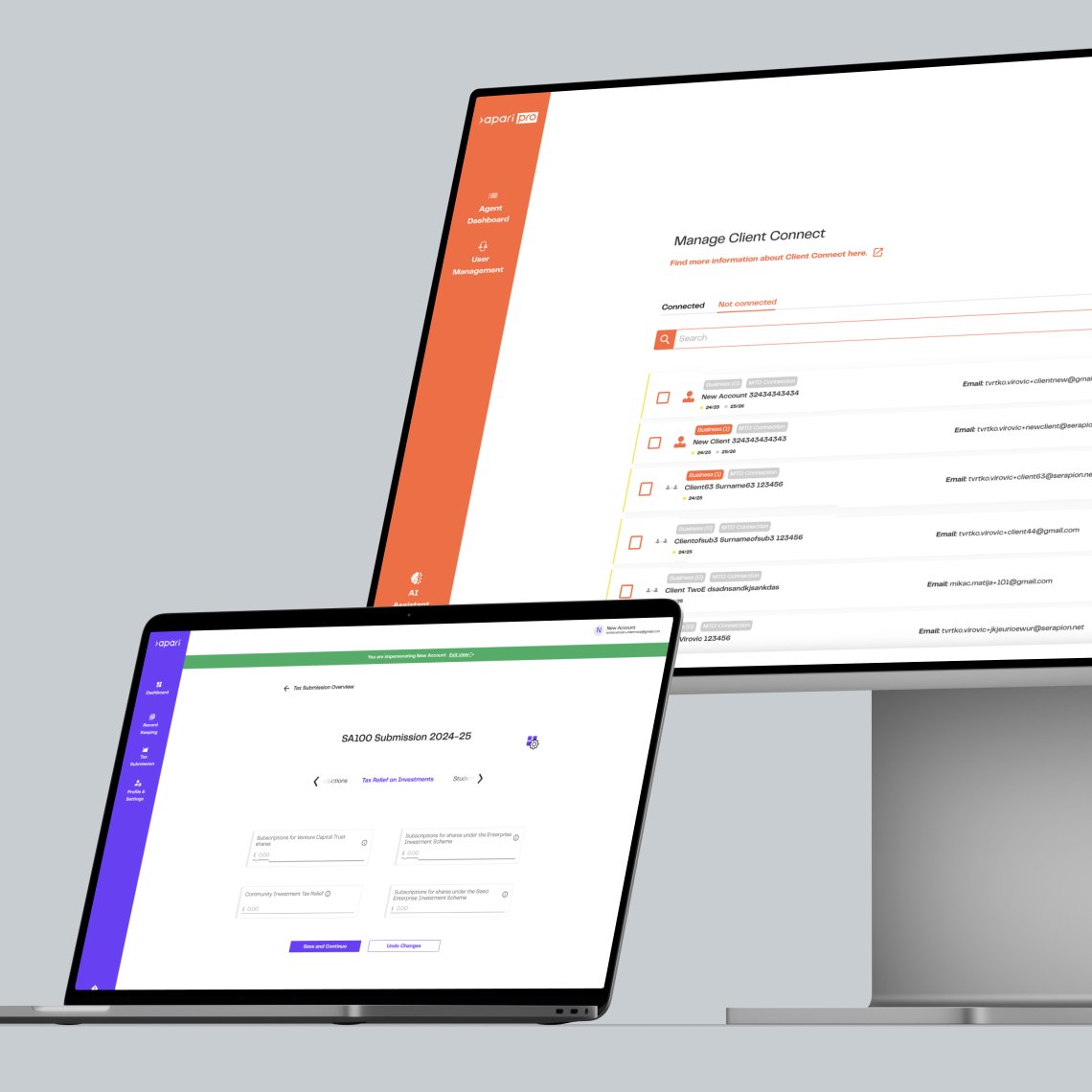

Designing a scalable system with multiple services for specific business needs.

Ensuring high code quality through thorough testing with Cypress and Zephyr Scale.

Working closely with Apari’s team to align technical solutions with business needs.

Efficient planning and development ensured timely delivery and quality.